Buzzflash details Bush Harken Trade

From Buzzflash:

The Bush Harken Insider Trading Collection

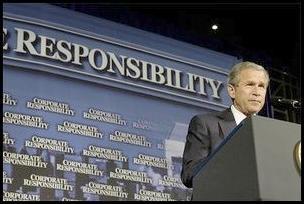

Don't let Bush fool you, he's as slimy a businessman as any that ran Enron.

Harken Energy Chronology

October 25, 2002

The purpose of this chronology is to show plainly and clearly that:

1. President George W. Bush did indeed have material non-public knowledge of adverse financial conditions at Harken Energy Co. prior to the sale of his Harken stock and therefore violated 15 U.S.C. § 78u-1 , insider trading of securities based upon material non-public information.

2. The Securities and Exchange Commission was indeed aware of Bush’s insider trading violation and chose to stand down.

3. While serving on the Board of Directors at Harken Energy Company, George W. Bush’s performance, motives and ethics were no different than those of the corporate executives and officers of Enron, Worldcom or any other national corporation being criticized by Bush for doing what he did.

4. The Aloha Petroleum sale was an act of fraud and Bush was in a position to know it and prevent it.

5. George W. Bush sought business dealings with people strongly connected to and involved with BCCI, the empire of fraud and crime.

http://www.scoop.co.nz/mason/stories/HL0210/S00178.htm

Harken Energy Corporation Internal Documents

October 31, 2002

"The documents the Center [for Public Integrity] has obtained do not unambiguously resolve the question of what Bush knew about the sale of the Aloha subsidiary."http://www.public-i.org/...

Board was told of risks before Bush stock sale

October 30, 2002

"One week before George W. Bush's now-famous sale of stock in Harken Energy Corp. in 1990, Harken was warned by its lawyers that Bush and other members of the troubled oil company's board faced possible insider trading risks if they unloaded their shares."http://www.boston.com/...

Harvard invested heavily in Harken

October 30, 2002

"Back then there was relatively little focus on one major reason for the loss: Harvard Management's large and ill-timed bet on little-known Harken Energy Co., whose board included George W. Bush, then the son of the US president and now the president himself. Even as losses mounted, Harvard Management bailed out the troubled company, first by splitting up Harken and then by sheltering Harken's liabilities in a partnership"http://www.boston.com/...

Bush Oil Firm Did Enron-Style Deal - Report

October 9, 2002

"President Bush's former oil firm formed a partnership with Harvard University that concealed the company's financial woes and may have misled investors, a student and alumni group said in a report on Wednesday."http://story.news.yahoo.com/news...

Memos: Bush knew of Harken's problems

July 12, 2002

"When President Bush sold more than 200,000 shares in Harken Energy Corp. in June 1990, he said he did not know the company was in bad financial shape. But memos from the company show in great detail that he was apprised of how badly the company's fortunes were failing before he sold his stock -- and that he was warned by company lawyers against selling stock based on insider information."http://www.salon.com/politics/...

Bush: Don't do as I did. President's proposals would bar type of loans he got from Harken EnergyJuly 11, 2002

"President Bush borrowed money from oil company Harken Energy Corp. while he was a member of its board, a practice he condemned this week as part of his plan to curb corporate abuse and fraud, the White House acknowledged Thursday."http://money.cnn.com/2002/07/11/news/bush_loan/

Bush and Harken Energy

July 10, 2002

"Although the law requires prompt disclosure of what are called insider sales, or sales by senior executives, Mr Bush did not inform the securities and exchange commission (SEC), the US market regulator, until 34 weeks later. So technically Mr Bush was at fault."http://www.guardian.co.uk/bush/story/0,7369,752706,00.html

Bush and Lay: A Common Pattern of Stock Dumps?

February 2, 2002

"In June of 1990, Bush sold two-thirds of the Harken stock he had received in the Spectrum 7 deal--and collected $318,430 more than it was worth when he first obtained it. Get low, sell high? Anything wrong with that? The month before this sale, Harken appointed Bush to a committee to determine, as Ivins and Dubose put it, "how restructuring [of the firm] would affect ordinary shareholders." According to Ivins and Dubose, who note the previous reporting work of "U.S. News and World Report," when Bush served on this committee, he was privy to information indicating the company was in trouble. He then dumped his stocks before this news became public. "U.S. News" concluded that at the time of the sale there was "substantial evidence to suggest that Bush knew Harken was in dire straits.""http://www.thenation.com/capitalgames...

Bush Name Helps Fuel Oil Dealings

July 30, 1999

"By the end of September 1986, the deal was done. Harken assumed $3.1 million in debts and swapped $2.2 million of its stock for a company that was hemorrhaging money, though it had oil and gas reserves projected to produce $4 million in future net revenue. Harken, a firm that liked to attach itself to stars, had also acquired Bush, whom it used not as an operating manager but as a high-profile board member."http://www.washingtonpost.com/wp-

* * *

If you know of an article that belongs on this page, email us at buzzflash@buzzflash.com.

0 Comments:

Post a Comment

<< Home